King Township council holds line on taxes for 2018

Higher property assessments will mean higher tax bills for some

Yorkregion.com

Feb. 6, 2018

Simon Martin

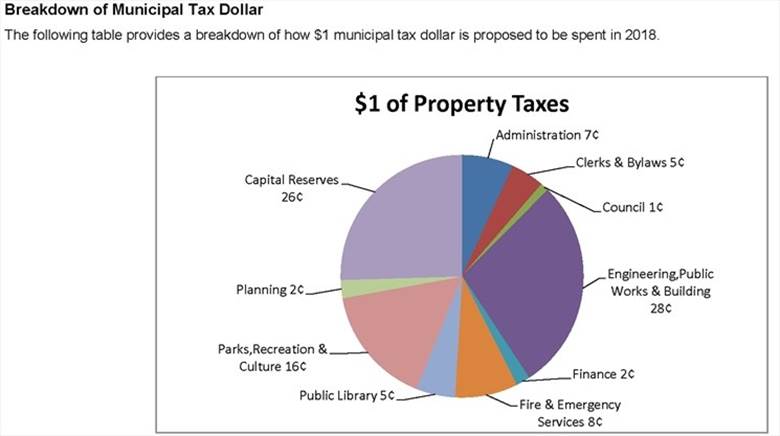

A pie chart shows the breakdown of how one municipal tax dollar is spent. - Township of King

King Township council is attempting to hold the line on property taxes. Council unanimously approved the budget at the Feb. 5 council meeting with a zero per cent increase in the net township’s tax levy requirement and a projected reduction to the tax rate by about eight per cent for the township’s portion of the property tax bill. The final tax rate will be determined when the region and provincial education rates are known. It’s believed the regional portion of the tax bill may increase slightly over last year.

“We’re proud of what staff and council have achieved with this budget,” Mayor Steve Pellegrini said. “We’ve managed to sharpen our pencils and reduce the township’s tax rate while continuing to make contributions to our reserves and make needed investments in our infrastructure. This strategy helps us plan for the future with more financial certainty and sustainability.”

Maintaining the township portion of the tax levy requirement will assist homeowners who experienced significant increases in their property assessment values last year. Taxpayers who experienced assessment value increases over 7.5 per cent will continue to see some increase as the increased assessment impact is phased in over the next three years, however, with the reduction to the township’s tax rate, the impact will be less than it was in 2017.

For every residential tax dollar collected by the township, the estimated portion retained by King is 40 cents, York Region gets 41 cents and the province gets 19 cents for education.

“This year’s budget shows we can invest wisely while also operating within our means,” Pellegrini said.

In addition to infrastructure investment, property tax dollars pay for a wide range of programs and services, Pellegrini said.

“Here are just a few things you get for your tax dollars: snow removal from roads and sidewalks, road and bridge repairs and maintenance, fire and emergency services, parks, arenas and four library branches,” he said.

The township’s $26.9-million capital budget includes $10.4 million for improving roads and bridges; $1.7 million for parks, recreation and culture projects; $200,000 for libraries; and $11.8 million for municipal buildings.

For the average home in King valued at $784,000, the King portion of the property tax will be $2,755.