2018 tax rates decrease

NRU

July 25, 2018

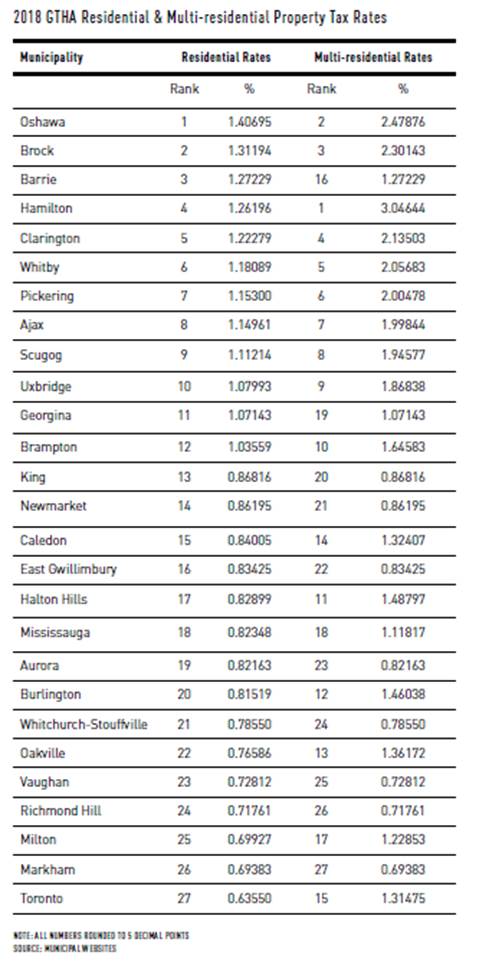

The City of Oshawa continues to have the highest residential property tax rates in the GTHA and the City of Toronto the lowest.

Residential and multi-residential tax rates continue to decrease at a steady rate, when compared to last year’s rates. On average, residential tax rates decreased by 0.04170 per cent and multi-residential tax rates decreased by 0.06833 per cent.

For the seventh year in a row, Durham Region municipalities are among the GTHA municipalities with the highest residential tax rates, with Oshawa staying at number one despite a reduction of 0.07773 percentage points.

Oshawa finance services commissioner Stephanie Sinnott told NRU that this reduction is a result of raised property assessment values and is the city’s way of ensuring that residential taxpayers don’t have to pay bigger bills.

“At the end of the day, it should benefit taxpayers of the community,” she said.

Hamilton continues to have the highest multi-residential tax rates, while Vaughan, Richmond Hill and Markham continue to be at the bottom of the list with the lowest multi-residential tax rates.

Look for the 2018 GTHA commercial and industrial property tax rates in the August 1 edition of NRU.