Toronto region home prices forecast to rise 6.8% next year

Royal LePage is forecasting an average price of $901,392 for detached homes by the end of next year.

TheStar.com

Dec. 13, 2017

Tess Kalinowski

One of the country's biggest residential real estate companies is forecasting a 6.8 per cent increase in Toronto area housing prices next year with starter homes - particularly condos - expected to be in high demand again.

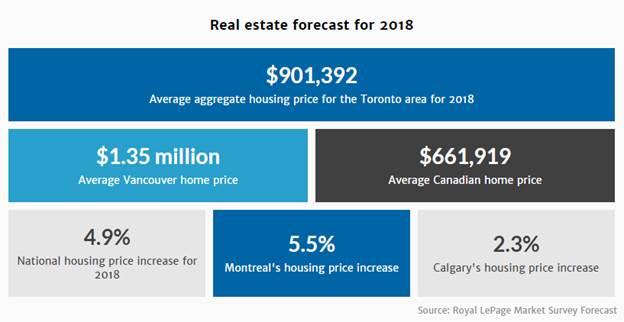

Royal LePage says the average aggregate price in the region - condos to single-family, detached houses - will be $901,392, compared to $844,000, its 2017 year-end estimate.

That is the highest increase forecast among nine Canadian centres, including Vancouver, in the company's annual Market Survey Forecast, released Wednesday.

It predicts new mortgage stress test rules kicking in Jan. 1 will mean a slow start to 2018. Many move-up buyers, who can't qualify for the financing to purchase the housing they want, will probably delay putting their existing homes on the market.

But the lack of housing supply in big city markets, including Toronto, is forecasts to drive prices up once the market adjusts to the new mortgage rules.

The stress test is one of several variables influencing the Toronto region housing market, said CEO Phil Soper.

But the health of the economy with high employment and population growth will override other factors such as new lending rules and the Ontario government's market cooling measures launched in April.

"If we didn't have a series of initiatives that were all designed to slow the housing market, we would be in to double-digit home price increases again," he said.

While the new policies such as the Ontario foreign buyers tax and the requirement that borrowers qualify for loans above the current low interest rates, are a good thing for Toronto's affordability challenges, they are more problematic for other Canadian markets such as Fredericton, Winnipeg and Calgary, said Soper.

High demand for entry-level properties is likely to surge next year, says the report. The tight vacancy rate is also expected to continue, particularly in Toronto and Vancouver.

Seventy-six per cent of Royal LePage agents in the Toronto area, who offer rental services, say multiple offers in tenant-landlord transactions are increasingly the norm. Among those agents, 68 per cent said the high cost of home ownership was driving rental demand.

Demand will continue to outpace supply in those markets as immigration boosts the population and millennial consumers hit their child-rearing years, searching for an affordable house with a yard.

"Everywhere in Canada is growing because so many millennials (particularly those in the 25 to 30 year age-range) are moving into the housing market. We've got a lot of immigration," said Soper.

But only Toronto and Vancouver are destinations for people migrating from other provinces.

The cost of living is cheaper in other centres but wages and job opportunities are higher in the Toronto region so people choose to live here.

"This is the kind of place young, smart enterprising people and, capital, want to work" he said.

Royal LePage predicts that the average Canadian home price will rise 4.9 per cent to $661,919 next year, from its 2017 year-end forecast of $631,000.

Vancouver home prices are forecast to increase 5.2 per cent next year to an average $1.35 million, as a result of limited supply and overall economic health.

Price change forecast for 2018 Canadian housing markets

- Canada: 4.9%

- Toronto: 6.8%

- Montreal: 5.5%

- Vancouver: 5.2%

- Ottawa: 3.2%

- Calgary: 2.3%

- Edmonton: -1.5%

- Winnipeg: 4%

- Halifax: 2.5%

- Regina: 0.7%