2017 residential and multi-residential tax rates - GTHA rates decrease

NRU

Aug. 2, 2017

By Sarah Niedoba

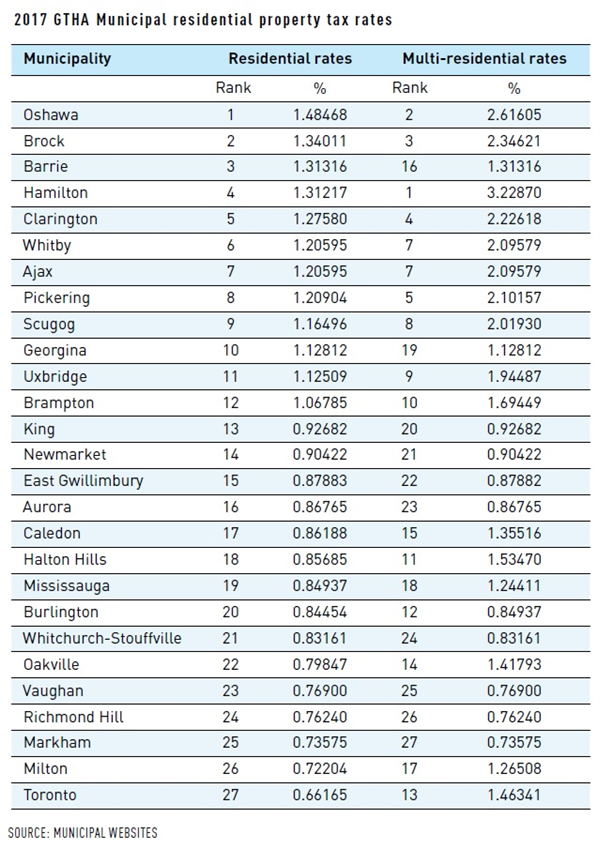

Residential and multi-residential property taxes rates decreased in all municipalities across the GTHA in 2017, when compared to 2016. On average, residential property tax rates decreased by 0.04331 per cent, while multi-residential property tax rates decreased 0.04775 per cent.

Hamilton finance, administration and revenue generation director John Hertel told NRU that tax rates have gone down because of a rise in property value across the GTHA. Every four years, Ontario's municipalities reassess the value of their properties, when property values go up, property tax rates decrease.

"This was a reassessment year for the province," he says. "So our tax rates have gone down because our property assessments have gone up."

There were no changes to the residential property tax rankings between 2016 and 2017. For the sixth year in a row, Durham Region municipalities, led by Oshawa, have among the highest residential tax rates, while Toronto has the lowest residential rate in the region. Once again, York Region municipalities have the lowest multi-residential rates in the region and Hamilton again has the highest rate.

Look for the 2016 municipal commercial and industrial tax rates in the August 16 GTHA edition of NRU.