You’ll need six figures to buy almost any GTA home, $200,000 a year for the average detached Toronto house, report says

As the cost of Toronto-area housing rises, so do the financing challenges for young adults.

TheStar.com

Aug. 17, 2017

Tess Kalinowski

It takes a six-figure income to afford virtually any Toronto area home — even a condo — and that expense is presenting a considerable financial challenge to an important cohort of millennial consumers.

Separate studies from two real estate companies on Thursday paint pictures of the high income requirements of affording a home, and of the housing aspirations of Canada’s “peak millennials” — adults 25 to 30.

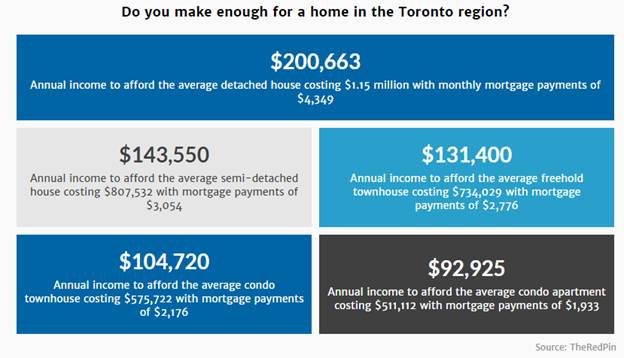

It takes a household income of more than $200,000 a year to carry the $1.15 million cost of the average detached house in the Toronto region, according to a report from TheRedPin brokerage.

Even the average condo, costing $576,000, requires an annual income of $92,925 to afford a $1,933 monthly mortgage, plus taxes, utilities and condo fees, according to the report.

Meantime, 59 per cent of those aged 25 to 30 in Ontario would like to own a detached house in the next five years, but only 30 per cent think they will be able to afford one, according a new Royal LePage report based on findings by Leger research.

According to TheRedPin, buyers need more than $150,000 a year to cover the cost of a home in half of 22 Toronto area municipalities.

The average Toronto home price, $864,228, is affordable to buyers with an annual income of $147,750 — though that average may be skewed lower by the large number of condos on the market.

The most expensive real estate in the region is in King Township. Buyers there need $264,000 a year to afford the monthly mortgage of $5,883 and other expenses for an average home price of $1.6 million.

In Oshawa, an annual income of $108,773 is enough to afford the average home price of $552,268.

TheRedPin study averaged home prices over the first seven months of the year, and assumed a 20 per cent down payment and a 2.99 per cent mortgage, amortized over 25 years. The income requirements took into account the areas’ average utility costs and property taxes and estimated condo fees based on a 900-square-foot condo townhouse and a 750-square-foot apartment.

Matching home prices to income levels gives buyers a more precise picture of what they can afford, said the brokerage’s Enzo Ceniti.

“It can be hard to grasp exactly how much you need to earn to be able to invest in a home. Information about home prices increasing or decreasing by a certain percentage isn’t as relevant or as personalized,” he said.

Drew Rankin, 29, is part of an age group that will grow by 17 per cent in Canada by 2021. He is among the 35 per cent in that cohort that already own a home, according to a report from Royal LePage.

Like 25 per cent of his contemporaries, Rankin and his girlfriend had help from family with the down on the one-bedroom-plus-den he had been renting near King St. and Spadina Ave. for about $465,000.

The 700-square-foot unit had the layout and location Rankin and his girlfriend wanted.

“In terms of where our mindset was, the lifestyle was top of mind, accessibility to friends, restaurants, even work. Sports, concerts, everything is right there,” he said.

But the condo isn’t big enough to raise a family.

“I grew up in London, Ont., in a middle-class neighbourhood with a yard and I don’t necessarily view that as an attainable lifestyle for me (in Toronto), at least not in the next 10 years,” said Rankin.

People in their late 20s face significant affordability barriers compared to their parents when it comes to housing in Toronto, said Royal LePage CEO Phil Soper. While cities have the best employment prospects for young adults, they are also the most expensive property markets.

The company’s report, he said, “is either a sobering insight into the challenges young people will face as they try to build homes and families or it’s a really optimistic view of Canadian economics. Two thirds of people say they’re going to have a difficult time buying a house because of affordability but nearly all of them want one — 87 per cent,” he said.

“More adults in Ontario than anywhere else in Canada hope to own a home in the short-term even though it’s the most expensive place in Canada to own a home,” said Soper.

Condo owner Rankin thinks Toronto real estate offers good value “relative to other global centres.”

“I have a lot of friends in New York,” he said, “and that’s a totally different scenario.”