Lull in Toronto-area housing market expected to linger

The new TREB forecast sees single-digit price increases for rest of 2017 as number of sales continue to decline.

TheStar.com

July 6, 2017

Tess Kalinowski

The Toronto Real Estate Board (TREB) expects the lull that has fallen over the housing market since April will continue with single-digit year-over-year price increases for the duration of 2017.

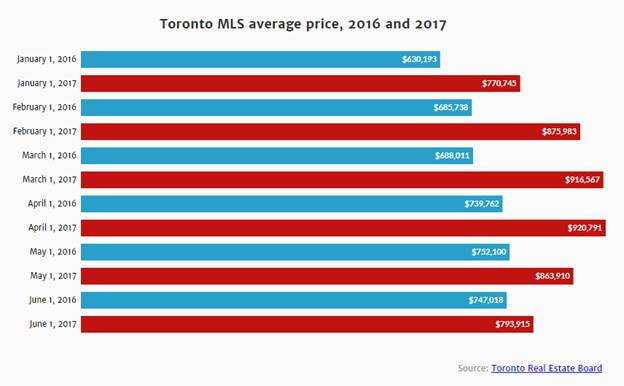

The board issued a revised annual forecast on Thursday along with month-end statistics showing that the average selling price in the Toronto region was 6.3 per cent higher in June year-over-year, even though the market experienced another month-to-month drop.

The average price of a home in June was $793,915, about 8 per cent or roughly $70,000 lower than the May average.

The number of transactions also fell again last month — 37 per cent year-over-year and 22 per cent below the average June for the past decade.

Listings were up about 16 per cent, but that was far less dramatic than the 49 per cent surge in re-sales homes that hit the market in May.

TREB is now calling for an annual price gain of 13 to 18 per cent this year compared to last.

It has lowered the number of home sales it expects in 2017 to between 89,000 and 100,000 transactions, after forecasting 104,500 and 115,500 at the start of the year.

The revised forecast takes into account the double-digit increases of the first part of the year that peaked at 33 per cent in March, and also the likelihood that the Bank of Canada will raise lending rates, as early as next week.

TREB’s May consumer research shows the number of potential buyers has gone up since November, but the proportion of first-time buyers likely to enter the market has fallen, said Jason Mercer, director of market analysis.

Where prices and sales land within the forecast range depends on whether buyers, who have stepped back from purchasing since the province introduced its foreign buyers tax in April, are ready to get back into the market. It will also depend on how many re-sale homes come on the market, he said.

Vancouver experienced a similar lull after it launched a 15 per cent foreign buyers tax last year, said Mercer.

“You’re starting to see people moving back in (Vancouver) because, if you’re not a foreign buyer, you’re not really affected by this move except psychologically,” he said.

But one realtor thinks TREB’s forecast could be optimistic. John Pasalis of Realosophy, who tracks Toronto region sales weekly, says it’s possible that prices will actually be lower year over year by the end of 2017.

Although most buyers aren’t affected by the province’s new Fair Housing policies, the psychological effect of the climbing cost of housing runs deeper.

“It’s like the market is saying, ‘This was stupid what happened in the first quarter.’ We look at the 33 per cent and it’s insane. But that’s an average. A lot of areas in York region were actually up 50 per cent,” he said.

“People saw that and it freaked them out,” said Pasalis.

“If prices had gone up 5 per cent rather than 33 per cent, we wouldn’t be here right now.”

Pasalis thinks some of the decline is due to an exodus of local property investors — buyers who bought second homes by leveraging their principle residence. Many have taken a loss on rent, thinking they would make it up by selling in the overheated market. But with a second consecutive month-to-month price slide, the numbers just keep looking worse, he said.

Although detached homes are taking longer to sell, given that buyers have so many more choices, Steven Green of Royal LePage Partners Realty says he still sees multiple offers on homes in desirable locations.

TREB reported the biggest declines in home sales were higher-priced detached houses, where the number of transactions was down 45 per cent year over year in June. The smallest decline in the number of sales was in condos, which dropped 23.4 per cent.

“The condo market is still very hot because people can’t afford houses,” said Green, who has been selling property for 30 years.

He expects an interest rate hike will actually spur more buyers back in the market.

“When the bank rate goes up, people like to jump in. If they’ve been looking for a house and they were in multiple offers in February, March, April and never got a house, now they have twice as many homes but the rates are going up — they want to jump in now. They’re getting a better deal on a house now too,” he said.

An RBC Economics bulletin on Thursday said the June numbers show how quickly housing market psychology can change. RBC said it expects a soft, rather than a hard landing, from Ontario’s new housing policies.

“While there’s a risk that a negative feedback loop for prices might be triggered by the current market correction, we believe that is remote at this point,” said the statement.

TREB’s benchmark index still showed a 25.3 per cent year-over-year price gain in June despite a 1.3 per cent decline between May and June. The index showed that condo prices rose 1 per cent.

The benchmark is considered a more accurate measure of home prices because it compares homes of similar size, location and age and isn’t as skewed by gains or losses in one or more particular categories.