How much have foreign buyers affected Toronto’s housing market?

TheGlobeAndMail.com

July. 14, 2017

Jill Mahoney

After months of intense speculation about the role of foreign buyers in the Toronto area’s overheated real estate market, this week marked an important milestone: the first detailed release of actual data.

But economists and industry watchers who analyzed the Ontario government’s numbers came to very different conclusions.

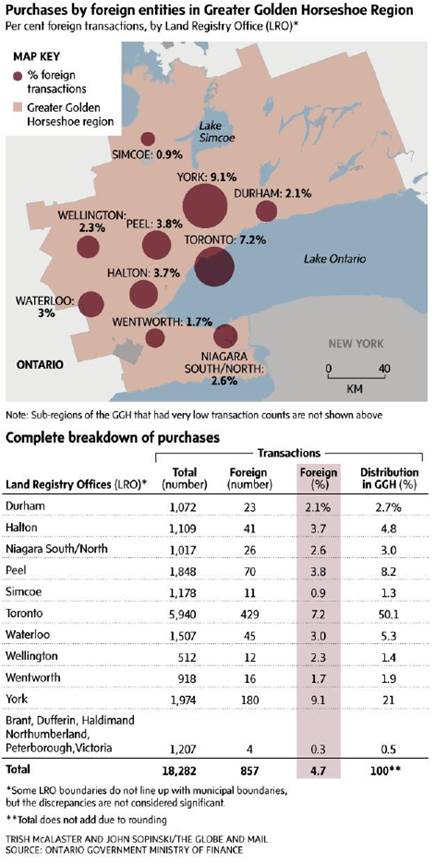

For some, the revelation that international investors accounted for 9.1 per cent of home sales in a recent month in York Region and 7.2 per cent in the city of Toronto was evidence those buyers were not the driving force behind the area’s recent unsustainable price gains.

For others, it was just the opposite: Such levels of foreign investment were clear signs of enough extra demand in an already robust market to send prices skyrocketing while pushing out many local buyers.

There is no widely accepted threshold at which experts agree that foreign home buyers start to drive up prices. While it is clear that overseas investors have had some impact on Toronto’s housing market, just how much remains the subject of great debate.

John Pasalis, a Toronto realtor who analyzes industry statistics and has been waiting for the first concrete data, argues that even though they comprised less than 10 per cent of buyers, according to the government’s official figures, an influx of several thousand foreign investors sparked the frenzied conditions that led to pitched demand, massive price gains and tight inventory.

“When you’re in a market that is already competitive like Toronto … then it is a tipping point,” he said.

Mr. Pasalis believes a deeper analysis of property sales by community – the province has only released statistics at the regional level – would find even higher rates of foreign investment in areas popular with overseas buyers, such as Markham and Richmond Hill.

Contrast that with John Andrew, a professor of real estate at Queen’s University in Kingston. He characterizes the rate of international investment in York Region – the highest in the broader area, with one in 11 homes purchased by foreign buyers – as a “very low number.

“It’s hard to imagine that’s going to have a tremendous impact,” he said.

U.S. researchers have examined a similar issue: the influence of out-of-town second-home buyers on housing markets in several U.S. cities in the 2000s. In a paper published in The Review of Financial Studies in 2015, they found that every percentage-point increase in the fraction of sales to non-locals in a given month was linked to a 1.9-percentage-point increase in price appreciation over the following year.

Part of the challenge in determining the role of foreign investment in the Toronto region has been a lack of data collection and dissemination. The Ontario government only began tracking sales to international buyers in late April, after unveiling a package of measures – including a 15-per-cent foreign buyers’ tax – intended to cool the market and calm a public outcry. By contrast, the B.C. government brought in a foreign buyers’ tax last summer after first gathering data on home buyers’ nationalities (initial results found foreigners bought one in every 10 homes in Metro Vancouver and almost one in five in the suburbs). The province continues to release detailed statistics every two months.

After repeatedly insisting it would not follow in B.C.’s footsteps, the Ontario government abruptly changed course on April 20 with the imposition of a levy on buyers of residential property in the Greater Golden Horseshoe region who are not citizens or permanent residents of Canada.

Before the tax was announced, the average price of a detached house in the Greater Toronto Area was up 33 per cent, to $1.21-million, in March compared with a year earlier. However, after the government’s move, average home prices tumbled 13.8 per cent in June from April’s high and the number of homes sold fell 37.3 per cent from a year earlier, according to data from the Toronto Real Estate Board.

York Region has been the hardest hit. The volume of sales in the affluent area plunged almost 60 per cent, and the average price was almost $200,000 lower in June compared with the March peak. At the same time, active listings were also up by 2,600 last month compared with March.

Some industry experts argue the government’s foreign home buyers’ data understate the true picture. While the figures are from sales that closed between April 24 and May 26, buyers were not required to disclose their citizenship until May 6. (Most contracts were signed before the announcement of the tax, given the conventional 60-day closing period.) Given this delay, overseas buyers may have been responsible for about 14 per cent of sales in York Region and 11 per cent in Toronto, assuming sales were constant throughout the period and that purchasers did not voluntarily report their citizenship before May 6, some analysts say.

Mr. Pasalis estimates that foreign citizens bought some 10,000 homes in the GTA in the span of one year before the tax was announced, assuming a rate of about 9 per cent in the region.

Josh Gordon, a professor at British Columbia’s Simon Fraser University who researches Toronto’s housing market, notes that tracking home buyers by citizenship doesn’t capture all the foreign capital that flows into the region’s real estate sector, decoupling prices from the local labour market, because some purchasers with offshore money are citizens or permanent residents.

“If there is a sudden surge of money, and supply takes time to build, then that can have a major impact on the market. That will lead to the tight inventory conditions that set off such craziness in Toronto,” he said.

However, industry observers agree that international buyers were not the only source of soaring demand and prices in the Toronto region. Domestic investors and speculators played a key role – perhaps even a larger one than foreign buyers, some analysts say – especially given recent price gains and low interest rates. The number of people owning more than one residential property in the Greater Toronto and Hamilton Area almost doubled between 2010 and last year, according to provincial data.

In addition, as a region that attracts significant numbers of newcomers, high immigration and migration levels contribute to higher demand for real estate.

As well, many realtors say the Toronto area’s recent soaring prices, bidding wars and low inventory prompted panic buying among local residents who were fearful they would miss out as prices continued to rise.

Prof. Gordon noted that many foreign investors favour higher-end houses, which creates a spillover effect. When non-citizens buy expensive houses in desirable neighbourhoods, thereby pushing up prices in bidding wars, locals who would otherwise purchase those homes are driven to secondary areas, which affects everyone else down the line, he argues. In addition, sellers who reap the benefits of higher prices often downsize to smaller homes and sometimes lend money for down payments to family members, which helps spur additional demand that is not captured in foreign buyers’ data.

“You have this money that arrives in the high-end areas that ripples out,” he said.