Newly built GTA home prices soar despite surge in re-sale listings

Prices still increasing as demand outstrips historically low inventories, say builders.

TheStar.com

May 24, 2017

Tess Kalinowski

A surge in re-sale listings this spring has not had an impact on the demand for new construction homes, which cost 40 per cent more on average in April than the same month last year.

The price of a newly built low-rise home — a category that includes detached, semi-detached and townhouses — was $1.2 million last month in the Toronto region, while detached homes alone averaged $1.8 million.

The cost of condos, which made up 70 per cent of new home sales in the Toronto region, rose nearly 24 per cent from April 2016 to $570,226, according to the statistics released by the Building and Land Development Association (BILD) on Wednesday.

“The additional re-sale listings only moved the needle on the supply situation from ridiculously tight to extremely tight,” said Patricia Arsenault, executive vice-president at Altus Group, which tracks sales for BILD.

There were 34 per cent more re-sale home listings in the Toronto region in April, according to Toronto Real Estate Board (TREB) figures released earlier in May.

But that still equates to only one month supply of single-family homes and three months for condos. A year ago, there was 1.5 months’ supply of single-family homes and 9.5 months’ inventory of condos, said Arsenault.

While the new and re-sale home markets are connected, there are always buyers who prefer new construction, she said.

For the first time in more than a decade, there were fewer than 10,000 new housing units available across the Toronto region in April.

That reflects strong demand rather than a reduction in the number of new homes coming on the market, said Arsenault.

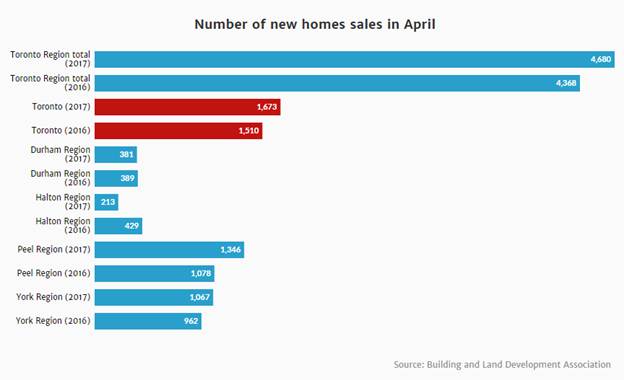

The number of sales actually increased 7 per cent compared to April 2016 and 24 per cent in the first quarter over the first four months last year.

More than 11,000 new homes came on the market in the first quarter of the year — that’s about a third more than the two-year average. But at the end of April only one in five of those were still available. In April 2015, it was two in five.

Amendments released last week to Ontario’s Growth Plan could further restrict the supply of new homes, said BILD CEO Bryan Tuckey.

The plan requires municipalities to concentrate population growth around services such as transit. It’s designed to slow urban sprawl by encouraging the development of denser housing forms such as condos and stacked townhomes.

“The new Growth Plan will do little to improve our problems with new housing supply and the resulting price increases in the GTA and surrounding area,” said Tuckey. “The devil will be in the details of how this plan will be implemented. Our current housing market problems developed under the existing Growth Plan which did not have the appropriate implementation supports. If the new plan does not receive the appropriate implementation support, it could make a bad situation worse.”

Meanwhile, Ontario’s 16-point Fair Housing Plan is curbing investor interest in new condos, according to online development hub BuzzBuzzHome.

The province’s plan aims to curb foreign real estate speculation by taxing off-shore, non-resident buyers. It would also expand rent controls to newer buildings.

Inquiries into Ontario developments dropped 49 per cent in the four-week period directly before and after the government’s April 20 announcement, said BuzzBuzzHome. Inquiries in the rest of Canada were up 36 per cent in the same period.

Only rental inquiries increased during those weeks — climbing 9 per cent.

“We certainly feel that the announcement of the Ontario Fair Housing Plan has the condo investment community possibly holding back new investment in order to fully consider the final effects of new legislation on their investment decisions,” said Greg White, vice-president of data.

That doesn’t necessarily mean that the government’s plan will tamp down speculation long-term, however, he said.

According to White, it “could be more of a reflection of the uncertainty factors.”