Obsession with home ownership driving Toronto affordability crisis, report finds

The Toronto area will need up to $150 billion in new home construction in the coming decade and most of that should be rental units, says a report from the Canadian Centre for Economic Analysis.

TheStar.com

May 23, 2017

Tess Kalinowski

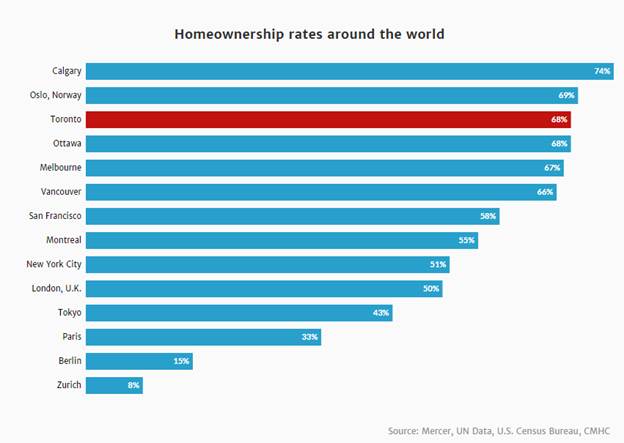

The Toronto region’s shockingly high house prices haven’t stopped the city from achieving one of the highest home ownership rates in the developed world, up 23 per cent over the past 35 years.

Toronto’s ownership rate, at 68 per cent, is behind only Oslo, Norway (69 per cent), and Calgary (74 per cent) among 38 western cities.

But ownership doesn’t equal affordability, says a sweeping study on the Toronto region’s housing crunch to be published Tuesday.

It suggests the Toronto area will need up to $150 billion in new home construction in the coming decade and most of that should be rental units to make housing more affordable.

The report by the Canadian Centre for Economic Analysis, a research firm, paints a picture of two cities in one. It shows that half of Toronto-area residents are overhoused, with 2.2 million empty bedrooms. (There are 400,000 homes in Ontario that have three or more empty bedrooms, according to the report.)

But it would take only about 350,000 bedrooms to appropriately house the 20 per cent of Toronto residents, most of them families, who are shelter-poor.

“If this was happening to our food chain or our water supply, we would have a visceral reaction. But because it’s happening in a very slow-burn housing market, it’s like heating up the frog very slowly in the pan — it doesn’t notice until it’s too late,” said Paul Smetanin, the centre’s CEO, who has assessed the effect of more than 40 housing affordability factors.

House prices are half the problem. But our obsession with home ownership is a big contributor, too, he said.

Toronto has restricted vast swaths of the city to single-family detached homes. That has led to a shortage of appropriate housing.

Smaller households are the most overhoused, as they are in neighbourhoods where the population is shrinking and aging. Meanwhile, larger families — with five or more people — are most likely to be underhoused in high-density apartments without enough bedrooms.

There’s also a shortage of ground-level homes known as the “missing middle” — townhomes, row houses, duplexes and small apartments — that would appeal to families.

Those, along with secondary suites, should have a greater presence in single-family neighbourhoods, but zoning doesn’t allow for it, Smetanin said.

The economic analysis centre has developed a Shelter Consumption Affordability Ratio index that measures housing affordability far beyond a household’s mortgage payments or rent. It factors in shelter-related expenses such as the cost of transportation to work and school, utilities, maintenance and property taxes.

Then it uses computer modelling to assess the effect other factors have on affordability. These range from property speculation to household debt levels and income levels, which have remained essentially flat for 30 years as housing prices continued to climb.

The index results show that one in three Toronto-area residents, and one in four in Ontario, suffers extreme affordability pressure.

“It is serious and has serious consequences for the development of our communities and the economy,” Smetanin said.

The report, “Understanding the Forces Driving the Shelter Affordability Issue,” was funded by the Residential Construction Council of Ontario, the Residential and Civil Construction Alliance of Ontario, the Ontario Association of Architects and the Ontario Construction Secretariat.

It will be presented at a conference Tuesday on the issue of “missing middle” housing in the region, which will include a panel of mayors from Mississauga, Brampton, Barrie and Ajax.

Data shows that rental housing acts as oil in the engine of housing markets, Smetanin said. It also illustrates the stigma attached to renting.

“If you reduce oil in an engine, you get heat and the heat starts to transpire as high housing prices, difficulty in moving and uncertainty. While your engine’s getting hotter, you’re not getting any faster or going somewhere quicker,” he said.

Most underhousing occurs in rentals.

“When you look at the data and the demographics of rental, it almost looks like that’s where we’ve parked all our luggage as a society — if you don’t own your own home, you’re a loser,” he said.

Property speculators fuel the expectation that prices will go up and they crowd out families looking for appropriately sized and priced homes.

“Investors are fine, but free market forces are not necessarily pleasant … You get winners and losers,” Smetanin said. “Sometimes the losers are completely unintended. They’re not people who took too much risk and should have been slapped on the wrist. They’re people who are trying to satisfy their needs. At times, letting free market forces do what they want to do hurts people.”

Rather than band-aids such as Ontario’s recently announced foreign buyer tax and expanded rent controls, he said, governments need to look at new concepts for Canadian housing.

In Europe governments, not-for-profit agencies and private industry collaborate on rental housing that is “architecturally relevant and desirable.”

“If we want to change things, we need to change collectively some of our attitudes,” Smetanin said. “If you do things the old way with the same people, but expect something different, then I believe Einstein mentioned that was the definition of insanity.”

Toronto housing in numbers

45%

Percentage of Toronto housing that is single detached homes, compared to 35% for apartments or condos and 20% in townhomes or “missing middle” housing

1/3

Proportion of Toronto-area condos that are rented out

30%

Of Toronto-area commuters spend 45 minutes or more each way getting to work or school

70%

Of Toronto-area commuters travel by car, compared to 85% outside the region

80%

Proportion of people in two-person households who are overhoused

67%

Proportion of people in households of seven or more people who are underhoused

75%

Proportion of Ontario residents aged 65 and older who are overhoused