Vancouver and Toronto at rising risk of housing correction, Poloz warns

TheGlobeAndMail.com

June 9, 2016

Barrie Mckenna

What goes up can also come down.

That’s the unambiguous message from Bank of Canada Governor Stephen Poloz, who took the unusual step of warning Thursday that surging home prices in the red-hot Toronto and Vancouver markets are unsustainable and could eventually fall back down to earth.

Economic “fundamentals” don’t justify a continuation of recent price gains in these two cities, Mr. Poloz said in his bluntest appraisal to date about overheated housing markets.

“Self-reinforcing expectations” are fuelling both a price runup and increasingly risky borrowing by some buyers, the central bank said in its twice-yearly assessment of risks buffeting the Canadian financial system.

Speaking to reporters later, Mr. Poloz said price rises in those cities have “gone beyond fundamentals,” such as job growth, incomes and immigration.

“This suggests that prospective home buyers and their lenders should not extrapolate recent real estate performance into the future when contemplating a transaction,” Mr. Poloz said in a statement.

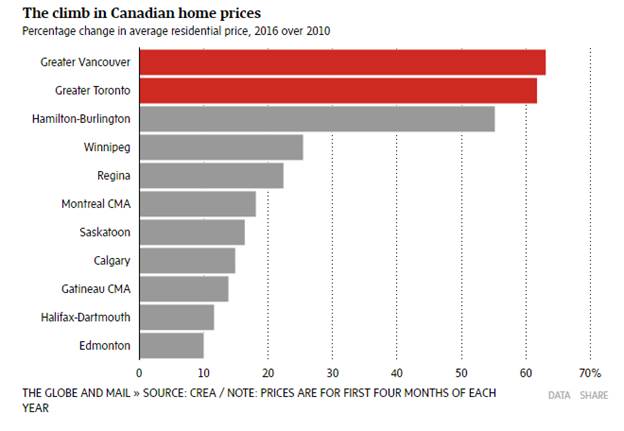

The reality for Mr. Poloz is that trying to cool the real estate market with words is the only effective tool he has, given the wide regional variations. Prices in Vancouver, Toronto and the surrounding areas are still surging, while they’re falling in the provinces hit by the oil price slump, and stable most everywhere else.

“He explicitly told Canadians: ‘Don’t buy your home on the expectation of house price appreciation.’ To me, that is a very clear signal that he’s trying to restrain housing behaviour,” said Frances Donald, a senior economist at Manulife in Toronto.

Mr. Poloz is in a tough spot, and only direct government intervention can alter the unique supply and demand conditions in these two cities, according to Ms. Donald. So Mr. Poloz is “doubling down” on his only effective tool: communications, she said.

“The Bank of Canada’s biggest issue is that monetary policy affects the country uniformly,” Ms. Donald explained. “It’s not capable of targeting particular regions.”

In spite of the rising probability of a house price correction, the central bank insisted that the overall risk to Canada’s financial system, while still high, is unchanged from six months ago, when it released its previous Financial System Review. That’s because the economy is continuing to improve and the risk of a recession has decreased, according to the bank.

“The bank will not move rates to cool housing unless they view it as a broader risk to the economy,” Bank of Montreal economist Benjamin Reitzes said in a research note.

Prime Minister Justin Trudeau also weighed in Thursday on rising house prices, acknowledging they’re limiting opportunity for many young Canadians. “Rising home prices, uncertainty around being able to buy your first home or upgrade as you want to grow a family is a real drag on our economy and a real drag on Canadians’ opportunities,” Mr. Trudeau told the Business News Network.

Earlier this week, federal Finance Minister Bill Morneau said the government is doing a “deep dive” on what’s going on in the housing market, but wouldn’t commit to when he might take further steps to try to cool it down.

Prices are now rising at a rate of roughly 25 per cent a year in Vancouver and 12 per cent in the Toronto area. The report identified limited supply of single-family homes and foreign buying as contributors to the sharp price gains, and the bank said price pressures are spreading to nearby cities, such as Hamilton and up B.C.’s Fraser River Valley.

“Foreign demand does contribute to price increases that are driving the rise in household indebtedness,” the report said.

What to do about a continuing influx of Chinese buyers has become a hotly debated issue, particularly in Vancouver, where a generation of buyers are being priced out of the market. Mr. Poloz admitted information on foreign buying remains “thin” in spite of government efforts to collect more data.

The hot market is also causing some buyers to engage in more risky borrowing, according to the Bank of Canada. The bank said 15 per cent of mortgages issued last year went to buyers with loan-to-income ratios of greater than 450 per cent, up from 12 per cent in 2014.

The bank also conducted a stress test of what would happen to borrowers in the event of a regional price correction. It found that a 15-per-cent price drop would leave 13 per cent of borrowers owing more than their homes are worth. And a 25-per-cent price shock would leave 23 per cent of mortgages under water.