Crunching the numbers in Ontario's 2016 budget

The Star looks at the Liberals’ tuition promises, cap-and-trade and other key points from in the 2016 budget.

thestar.com

Feb. 25, 2016

By William Davis

The Ontario Liberal government released its budget Thursday, outlining main financial objectives such as formalizing the cap-and-trade program, slashing post-secondary tuition and creating jobs.

Below are seven charts that help summarize some of the main points raised in the 346-page budget document.

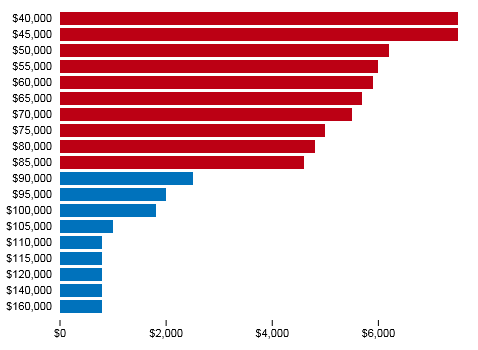

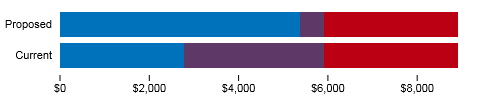

1. POST-SECONDARY TUITION

One of the biggest transformations is the government's role in funding postsecondary-education. They plan to make it more accessible and affordable by creating the Ontario Student Grant (OSG) for the 2017-2018 school year. Students from families with incomes under $50,000 will have no provincial student debt. 50 per cent of students from families with less than $83,000 annual income will receive non-repayable grants that will exceed average college or university tuition. This will be done by redirecting 100 per cent of the funding from the Ontario Tuition Grant, Ontario Student Opportunity Grant, Ontario Access Grant, and other OSAP-related grants. OSAP debt level will also be capped at $10,000 annually for higher-income level families.

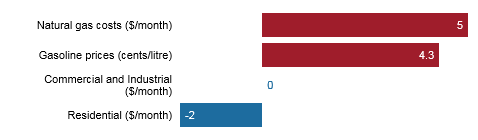

2. CAP-AND-TRADE

The government has released a strategy to integrate a cap-and-trade program as part of its economic plan. The Liberals reference severe frosts ruining apple crops in 2012 and a 2013 rainstorm that caused $940 million in damages in Toronto alone as examples of how climate change is already negatively affecting Ontarians. The program works by allowing businesses to buy emission allowances and reward these businesses if they are able to lower their emissions over time. The cap-and-trade proceeds would go towards new technology, transportation and home and business energy efficiencies. Energy consumers would see an increase in gasoline and natural gas prices while home energy prices could see an average decrease of $2 per month.

3. TRANSPORTATION INVESTMENTS

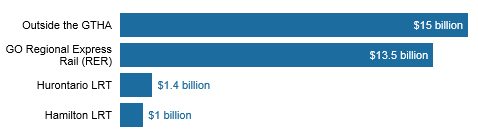

The province plans to invest more than $137 billion over the next 10 years in public infrastructure. This includes roads, bridges, public transit, hospitals and schools. In its Moving Ontario Forward plan, the province will invest in major transportation projects. Inside the Greater Toronto Hamilton Area, the budget will focus on GO Transit's Regional Express Rail (RER), the Hurontario LRT, the Hamilton LRT and aid in planning and design of other projects like the Toronto Relief Line. The province will also focus on expanding the high-occupancy vehicle (HOV) lanes on Ontario highways.

4. UNEMPLOYMENT RATE

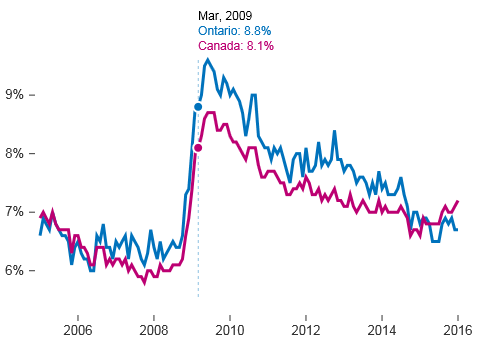

Canada's unemployment rate at the beginning of the new year was at 7.2 per cent, which is 0.5 per cent higher than Ontario's currently declining 6.7 per cent rate. The government claims that 600,000 jobs have been created since 2009 and plans to create 300,000 more jobs by the end of 2019. A competitive Canadian dollar and investment in transportation has helped Ontario grow, according to the Liberals. Ontario exports are expected to rise by 3 per cent annually during the 2016-2019 period and they project the unemployment rate to drop to 6.1 per cent by 2019.

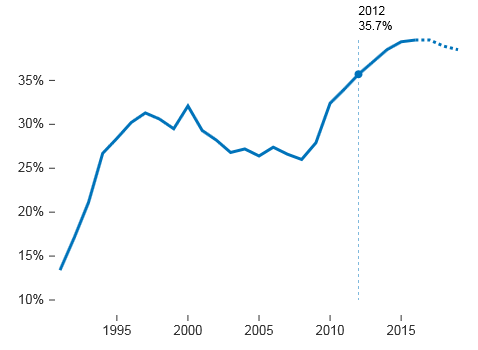

5. NET DEBT-TO-GDP

Ontario's net debt is the difference between liabilities and assets. In March 2016, the projected net debt-to-GDP will be $298.9 billion, $2.8 billion less than the 2015 budget projection. The province claims the increase in debt is because of its amplified investment in transportation and infrastructure. Net debt-to-GDP is set to peak this year and then begin to decline in 2017-18. The government plans to reduce this ratio to its pre-recession level of 27 per cent over an undisclosed period of time.

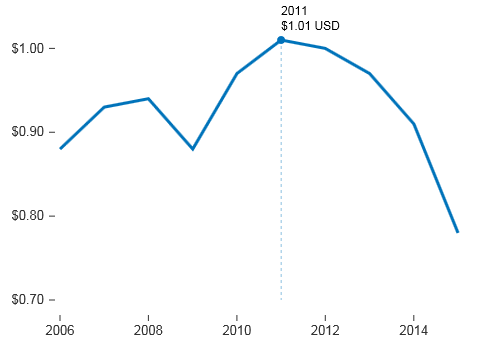

6. CANADIAN DOLLAR

Lower oil prices and diverging monetary policy with the U.S. have been noted as reasons for the depreciation of the dollar. The government says Ontario businesses sensitive to the exchange rate have seen the largest growth because of the competitive Canadian dollar, but also recognizes the added costs to domestic consumers and other business owners. Interest rates remain low, which has helped consumers make larger purchases, but these rates are expected to stabilize in 2016. Exports are seen to increase because of the low dollar, which should see further foreign investment in Ontario.