The ominous high-ratio mortgages of Toronto-Oshawa-Hamilton

TheGlobeAndMail.com

Dec. 16, 2016

Michael Babad

I Googled “in over your head definition” and here’s what popped up from the Cambridge Dictionary: “To be involved in a difficult situation that you cannot get out of: Sean tried to pay his gambling debts, but he was in over his head.”

Well, to paraphrase from a section of the Bank of Canada’s latest report, Sean indeed gambled by borrowing a bundle to buy a house in Toronto.

And it’s not just Toronto proper, but surrounding cities such as Oshawa and Hamilton, where there are Seans aplenty who are in deep over their heads.

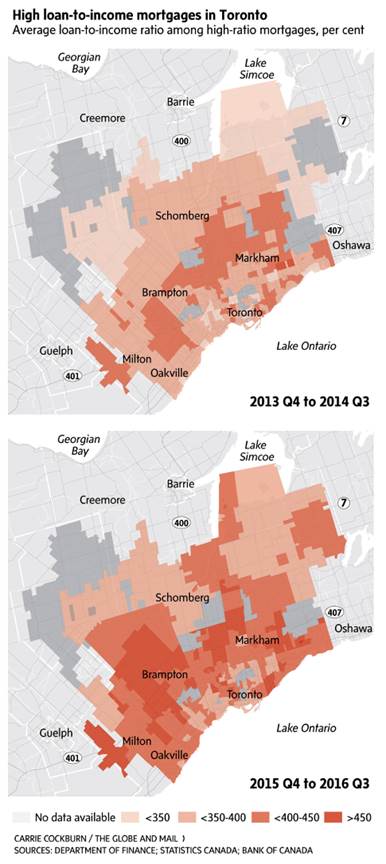

In its review of the financial system released Thursday, the Bank of Canada produced two heat maps that are shocking in what they say about the growing number of in-over-their-heads borrowers.

There are many in Vancouver and other Canadian cities, as well, but the situation is nowhere near as marked as in Toronto, where many new mortgages are flashing redder and redder.

What these maps show is the stunning rise in high-ratio mortgages, notably those with a loan-to-income, or LTI, ratio that tops 450 per cent.

In Toronto, a troubling 49 per cent of the mortgages originated in the third quarter fell into this category, up from 41 per cent a year earlier and 32 per cent a year before that.

For the purposes of comparison, the corresponding third-quarter numbers were 39 per cent for Vancouver, 32 per cent for Calgary, 13 per cent for each of Montreal and Ottawa-Gatineau, and just 7 per cent for Halifax. The national number stands at 18 per cent, growing and not good.

But no one is near the Toronto level.

“Moreover, high LTI mortgages are spreading throughout the Toronto area ... and are also extending beyond the boundaries of Toronto to adjacent cities, such as Oshawa and Hamilton,” the Bank of Canada warned.

“In these cities, the proportion of high-ratio mortgages with LTI ratios exceeding 450 per cent has more than doubled over the past three years, from around 10 per cent to roughly 25 per cent.”

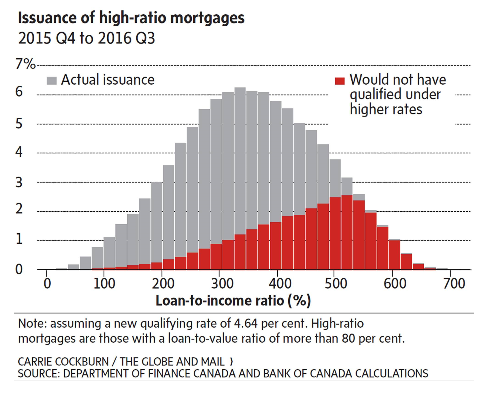

As The Globe and Mail’s Mike Hager, Brent Jang and David Parkinson report, the central bank believes that new mortgage and tax measures introduced by the federal government will help ease the situation, as the chart below suggests.

Of course, note that the central bank said these are mortgages that would not have been eligible under the new rules.

They were eligible then, feeding the Toronto frenzy.

Many observers have warned of the fragile nature of these mortgages, and the mounting vulnerability of borrowers should there be an economic shock. They’re not forecasting a meltdown, however, so we’ll keep our fingers crossed that there’s no such shock.

“Recent regulatory changes around income qualification and portfolio insurance for lenders will reduce the size of mortgages that many Canadians are able to qualify for and raise the cost of borrowing,” Toronto-Dominion Bank economists added in a new economic outlook.

“While previous tightening measures had only a short-lived impact, the newest changes may create more of a buyer response due to the parallel rise in mortgage rates and the higher sensitivity that occurs in markets with stretched affordability,” they added.

“The best offered five-year fixed mortgage rate has gained nearly a quarter-point since October, and further increases are expected.”

There’s always a but, right?

“The impact on the market is not likely to be immediate,” the TD economists forecast.

“In fact, the data is more likely to show a near-term demand bump, particularly in Toronto,” they added.

“Buyers tend to pull forward their purchases when they initially see changes occurring in mortgage rates and regulations. But, by the third quarter of 2017, a softening of housing markets should be evident, with the process intensifying as the year progresses. The one wild card remains foreign investor demand. Foreign buyers tend to be less sensitive to mortgage rates and may be driven to markets where tax changes on foreign purchases did not occur, like Toronto.”